What is Usual?

Usual is a decentralized, RWA-backed stablecoin issuer that redistributes ownership and value, providing growth exposure to its users through the $USUAL token.

$USUAL drives USD0 stablecoin adoption, aligning contributor incentives and fueling protocol growth. Its innovative distribution model, based on protocol revenue, paves the way for new DeFi possibilities. This approach accelerates ecosystem expansion and fosters sustainable decentralization.

Launched three months ago, it has now grown to $355M TVL and 50k users. The protocol raised $7M overall and is backed by 160 investors.

Why Was Usual Created?

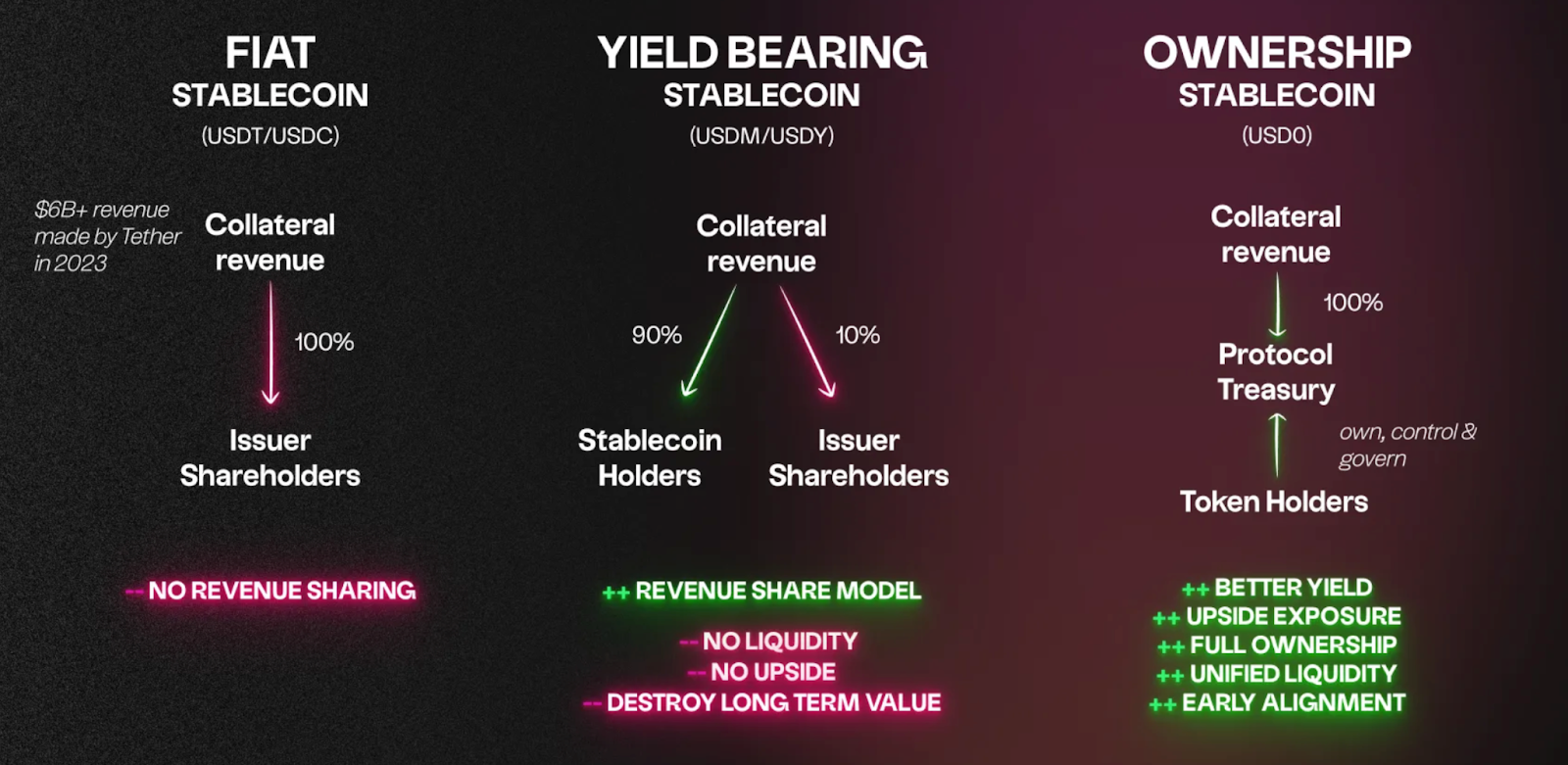

- The Stablecoin Problem: Stablecoins such as USDT and USDC generate significant profits (6B+ in 2023), yet the value they create is retained by a small group of shareholders. These entities operate similarly to centralized banks, privatizing profits while socializing risks.

- Flawed Tokenomics: Most tokens are speculative, serving insiders and diluting users. As a result, users hold tokens that continuously lose value.

- Why Usual? Usual was established to address these inequities by redistributing 90% of the ownership and generated value back to the community. It turns users from mere consumers into actual owners.

Not just Yield, but Growth exposure through Ownership

- Tether exclude users from participating in both yield and growth, directing it solely to Tether’s shareholders

- Yield-Bearing Stablecoins, issued by tokenizers like Ondo or Mountain, mark a significant evolution in the stablecoin landscape by redistributing underlying yields to users through permissioned stablecoins, but yield-bearing assets provide exposure to yield but not growth.

- Usual offers the best of both worlds. With Usual, you gain access to both yield generation and growth potential. Usual goes beyond by redistributing value through the $USUAL token, which grants users ownership in the protocol. Unlike revenue-sharing models, Usual pools all created value into its Treasury, with 90% distributed to the community via the governance token. It entitles users to:

- Actual Cash Flows: reflects protocol revenues, with future growth based on TVL and revenue.

- Governance Rights: allows holders to influence key decisions like revenue distribution and collateral management.

- Utility Rights: provides staking options, “Validator” and “Bribing” tokens to direct liquidity and enhance utility.

Usual User Flows

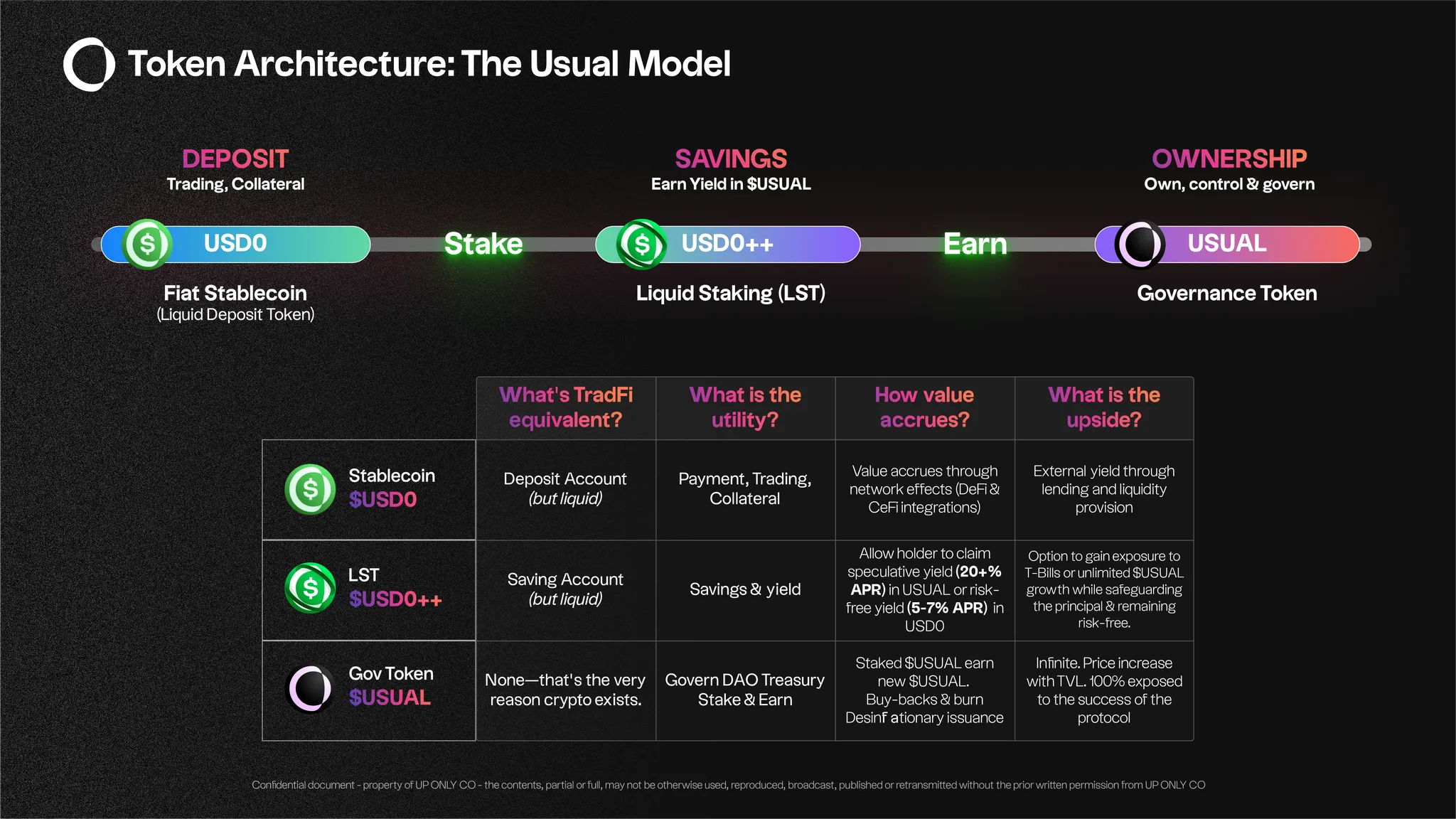

Usual is centered around three core products:

1- Usual Stablecoin (USD0)

Designed for payments, trading counterparty, and collateral use. USD0 is a stablecoin fully backed 1:1 by Real-World Assets (RWA) like US Treasury Bills. It provides users with a stable, secure asset that is independent of traditional banking systems, fully transferable, and accessible within the DeFi ecosystem. As the core stability asset of Usual, USD0 supports transparency and security by maintaining real-time reserves, offering a non-fractional, reliable alternative to stablecoins like USDT and USDC.

2- Usual Liquid Staking Token (USD0++)

A yield-generating product: USD0++ is a liquid staking version of USD0, acting like a savings account for Real-World Assets with a 4-year lock-up. It offers rewards while remaining transferable, with $USUAL rewards incentivizing the growth and adoption of USD0.

3- Usual Governance Token ($USUAL)

$USUAL is the governance token powering the Usual protocol, uniquely designed with an intrinsic value tied directly to the protocol’s revenue model. $USUAL drives the adoption and use of USD0, aligning incentives for contributors and fueling protocol growth. Its innovative distribution model sets the stage for new DeFi possibilities, accelerating ecosystem expansion and sustainable decentralization.

USUAL: A Revolutionary Revenue-Based Governance Token

What is USUAL?

$USUAL is the governance token powering the Usual protocol, uniquely designed with an intrinsic value tied directly to the protocol’s revenue model.

$USUAL drives the adoption and use of USD0, aligning incentives for contributors and fueling protocol growth. Its innovative distribution model sets the stage for new DeFi possibilities, accelerating ecosystem expansion and sustainable decentralization.

What Makes USUAL Different?

$USUAL isn’t just another governance token—it’s designed to give true ownership over the protocol and its treasury, backed by 100% of generated revenue. Issued in proportion to USD0++’s TVL, $USUAL is disinflationary, meaning that as the protocol’s revenue grows, fewer $USUAL tokens are issued. This model aligns early supporters’ interests by ensuring that $USUAL issuance is always tied to future cash flows, protecting long-term holders from dilution.

USUAL Token Use Cases

USUAL is a utility and governance token with several financial & utility key features:

- Governance control: Provides token holders with the power to manage the protocol and influence key financial decisions.

- Disinflationary issuance: Issuance of USUAL is tied to the TVL of staked USD0 (USD0++), creating scarcity as new TVL enters the system.

- Revenue based model: USUAL issuance is aligned with future cash flows. The inflation rate of USUAL supply remains lower than the growth of revenue and treasury.

- Staking rewards: By staking USUAL, holders activate governance rights and receive 10% of newly issued USUAL, incentivizing long-term behavior.

- Gauge mechanism: Directs and optimizes liquidity distribution within the protocol.

- Collateral management: Governance determines the collateral types and their respective weighting behind USD0, ensuring stability and flexibility.

- Treasury management: Governance and mechanics will enable USUAL holders to manage the treasury efficiently and maximize the compounding effect.

Some USUAL tokenomics

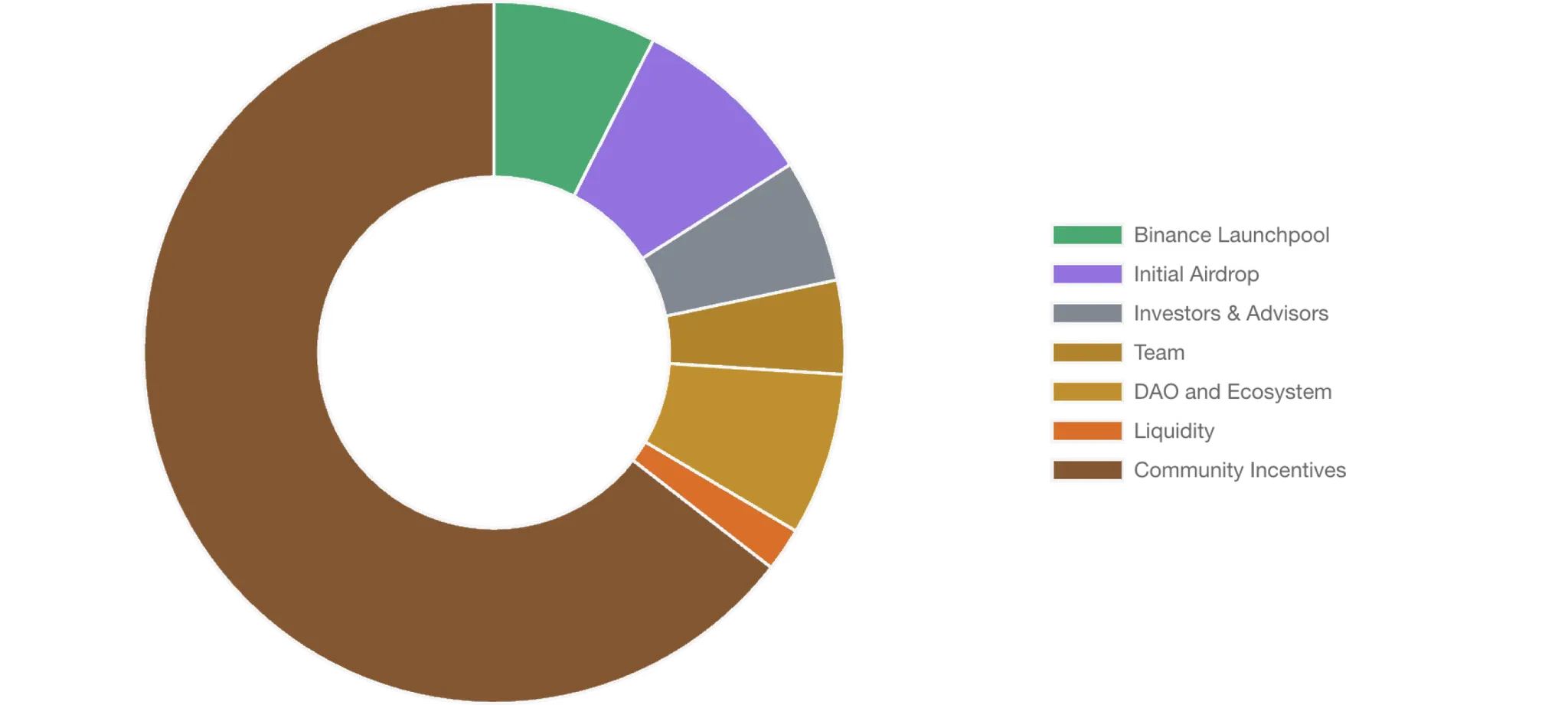

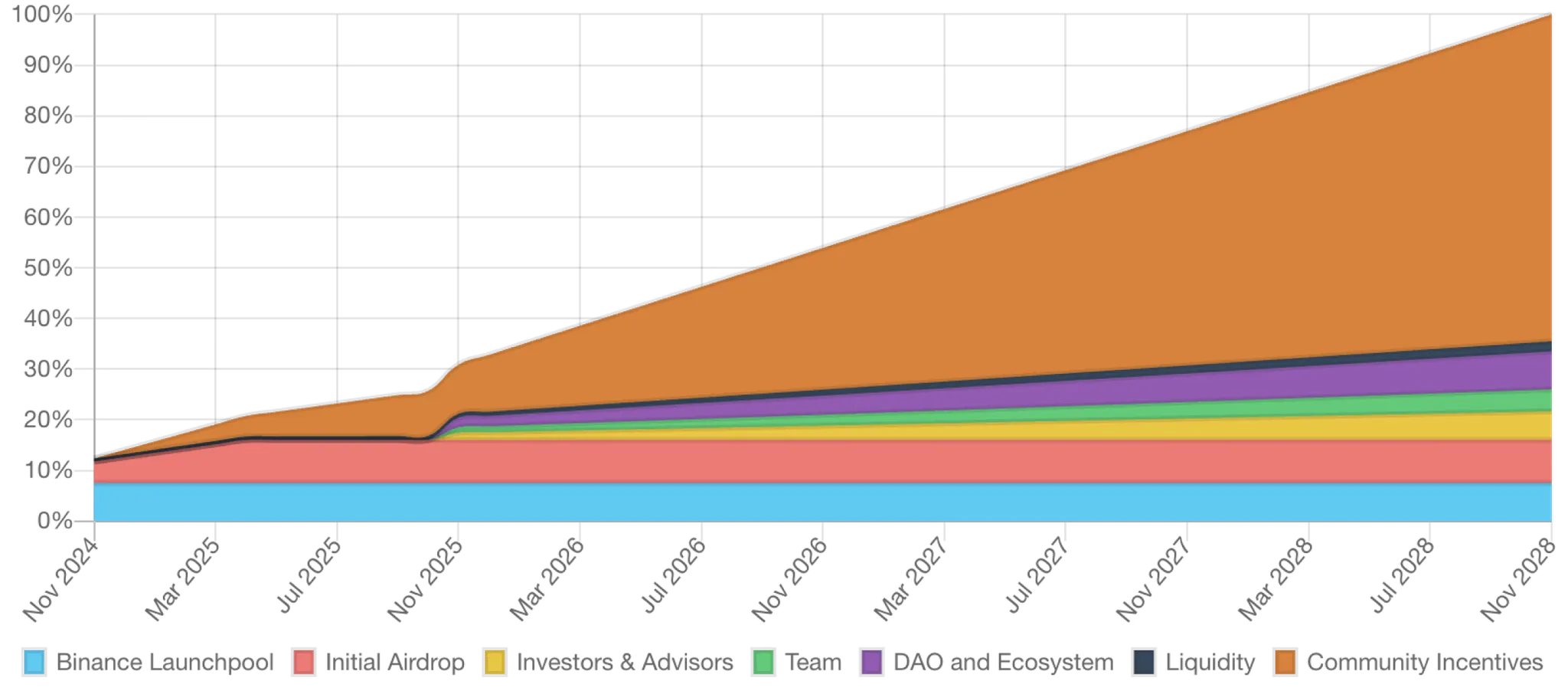

Usual is community-driven, with 90% allocated for the community and 10% for insiders.

| Token Name | USUAL |

|---|---|

| Binance Launchpool | 7.50% of the total token supply |

| Initial Airdrop | 8.50% of the total token supply |

| Investors & Advisors | 5.68% of the total token supply |

| Team | 4.32% of the total token supply |

| DAO and Ecosystem | 7.50% of the total token supply |

| Liquidity | 2.00% of the total token supply |

| Community Incentives | 64.50% of the total token supply |